When researching retirement savings options, gold IRAs often appear as attractive options. Both offer the promise of portfolio protection, but each comes with {uniqueadvantages and drawbacks.

A Gold IRA is a tax-advantaged plan that allows you to invest in gold bullion. On the other hand, acquiring tangible gold involves physically owning the asset.

- Aspects like your investment goals, tax implications, and access requirements all play a important factor in determining your ideal strategy.

Seeking advice from a experienced professional can provide valuable insights to help you get more info make an informed decision that suits your individual needs.

The Ultimate Gold IRA vs. 401(k) Battle

Deciding amidst the allure of a traditional investment account like a 401(k) and the potential of a Gold IRA can feel challenging. Neither option offers unique perks, making it important to carefully weigh your retirement goals. A 401(k) typically involves investments made from pre-tax income, potentially offering tax benefits. Conversely, a Gold IRA allows you to diversify your portfolio with physical gold, potentially hedging against market volatility.

- Consider your risk threshold.

- Investigate the fees associated with each option.

- Consult with a investment expert to design a plan that meets your unique needs.

Ultimately, the best choice for you will depend on your goals. Thorough planning and investigation are essential to making an informed selection.

Investing in a Gold IRA?

Deciding whether/if/if perhaps to invest in/add to/include a Gold IRA can be a complex/difficult/tricky decision/choice/call. On the positive/upside/beneficial side, gold is considered/seen as/viewed by many a safe haven/reliable investment/stable asset during periods of economic uncertainty/market volatility/financial instability. It also has the potential to hedge against inflation/protect your savings/preserve your wealth over time. However, there are also potential drawbacks/considerations/risks to keep in mind/be aware of/factor into your decision. Gold IRAs can have higher fees/greater costs/more expenses than traditional/standard/conventional IRAs, and the value of gold can fluctuate significantly/wildly/drastically, meaning you could lose money.

- It's essential to/You should always/Make sure to carefully research/thoroughly examine/meticulously investigate all aspects of a Gold IRA before making a decision/committing your funds/investing.

- Consulting with/Speaking to/Seeking advice from a qualified financial advisor can be helpful/beneficial/advisable in determining/figuring out/assessing if a Gold IRA is the right choice/option/fit for your individual financial goals/investment objectives/retirement plans.

Top-Rated Gold IRAs: Find the Perfect Fit for Your Portfolio

Securing your financial future demands careful consideration of diverse investment strategies. A bullion IRA presents a compelling option for individuals seeking to diversify their existing holdings.

But, navigating the detailed world of gold IRAs can be challenging without a sound understanding of key considerations. This overview aims to shed light on leading gold IRA providers, empowering you to make an informed selection that aligns your individual financial goals.

- Consider the provider's standing in the industry.

- Analyze fees and costs carefully.

- Research the types of gold products offered.

By performing thorough due diligence, you can confidently select a bullion depository that meets your expectations.

Unleashing the Potential of a Gold IRA Investment

A Gold Individual Retirement Account (IRA) presents a valuable investment opportunity for those seeking to diversify their portfolios against market uncertainty. By allocating a portion of your retirement savings to precious metals like gold, you can potentially reduce your overall vulnerability. Gold has historically served as a stable asset during periods of inflation, making it an appealing component to a well-rounded retirement plan. Additionally, the exemptions associated with IRAs can maximize the long-term return of your gold investment.

- Explore factors such as current market conditions, risk tolerance, and professional recommendations before making any decisions regarding your Gold IRA.

- Work with a reputable financial expert who has extensive knowledge of gold investments and retirement planning strategies.

Could A Gold IRA Worth It? Exploring the Benefits and Risks

A Gold Individual Retirement Account presents a compelling option for investors seeking to diversify their portfolios. Gold, as a precious asset, historically serves as a hedge against inflation and economic uncertainty. A Gold IRA allows you to hold physical gold within a tax-advantaged retirement account.

Nevertheless, it's crucial to thoroughly consider both the benefits and risks before investing in a Gold IRA.

- A key benefit is the potential for appreciation in value over time, as gold has a history of functioning well during periods of economic turmoil

- Furthermore, Gold IRAs can offer a level of variation to your retirement portfolio, lowering overall risk.

However, there are some risks associated with Gold IRAs. Specifically , gold prices can be unstable, meaning your investment value could decline.

- Moreover, There are potential fees associated with setting up and maintaining a Gold IRA, which can affect your overall returns.

- In conclusion, It's essential to collaborate with a reputable financial advisor to determine if a Gold IRA is the right investment for your individual needs and financial goals.

Jennifer Grey Then & Now!

Jennifer Grey Then & Now! Bug Hall Then & Now!

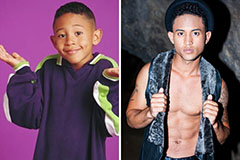

Bug Hall Then & Now! Tahj Mowry Then & Now!

Tahj Mowry Then & Now! Barry Watson Then & Now!

Barry Watson Then & Now! Kelly Le Brock Then & Now!

Kelly Le Brock Then & Now!